LEI in Cross-Border Payments

The LEI enables cross-border payment transactions to become faster, cheaper, more transparent, and more inclusive.

When the LEI is added as a data attribute in payment messages, any originator or beneficiary legal entity can be precisely, instantly, and automatically identified across borders. As payment market infrastructures across the world move to support instant payments, the ability to verify and validate the originator and beneficiary of a transaction in near real-time is a foundational requirement in order to enable consumers, businesses, and financial institutions to verify that funds are transferred across international borders to the correct entity.

The Financial Stability Board (FSB) has endorsed the LEI for supporting the goals of its G20-endorsed Roadmap for Enhancing Cross-Border Payments. As part of this initiative, and in collaboration with other industry standard-setting bodies, the FSB is currently working to promote standardized use in ISO 20022 payments messaging to mitigate constraints in cross-border payments. This includes the definition and harmonization of data fields - including identifiers - being transmitted along the payment chain.

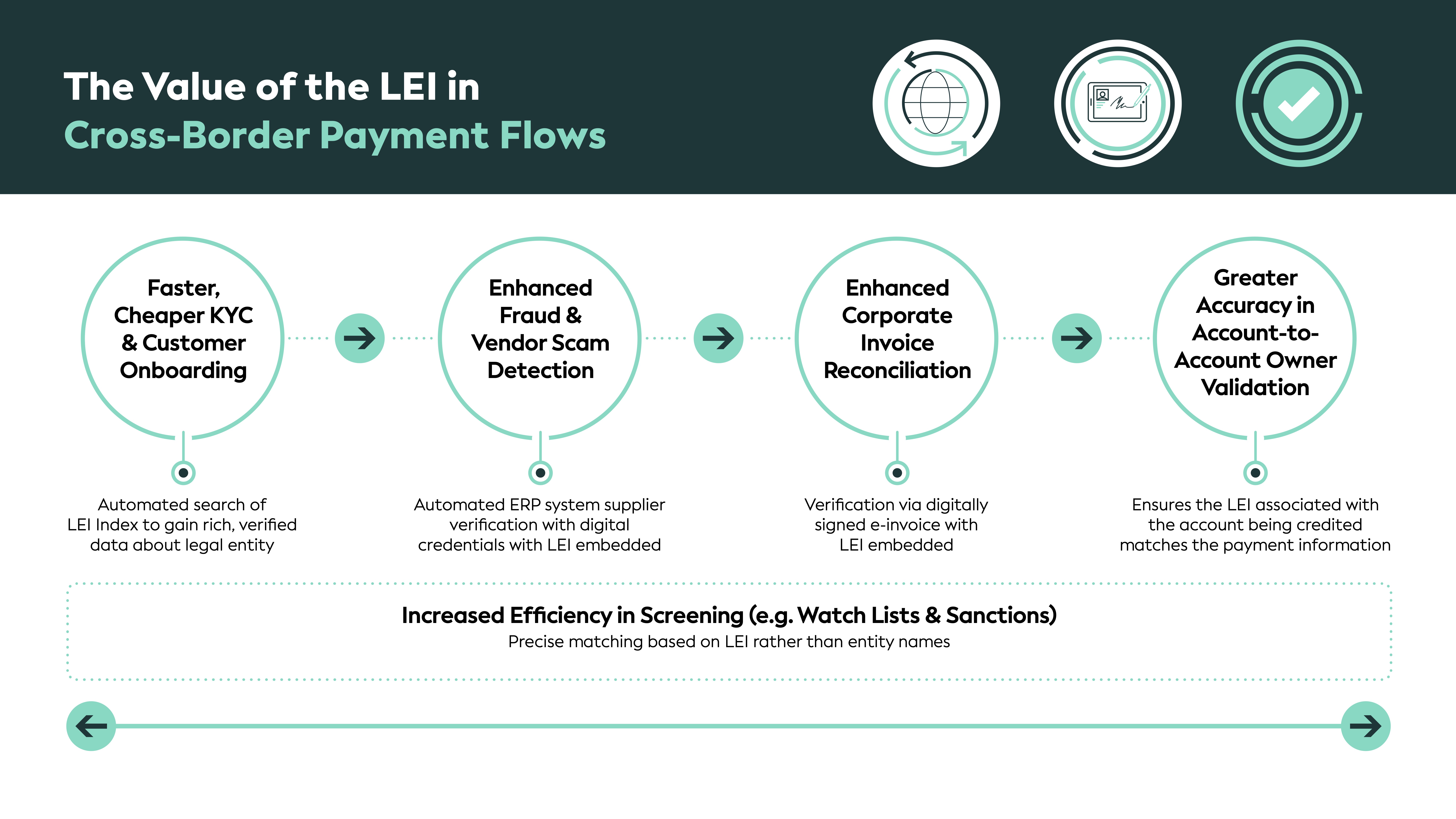

GLEIF is working with leading payments industry stakeholders to demonstrate the significant value the LEI brings to non-financial corporates and financial institutions when transmitted in cross-border payment flows. The five key use cases are: screening; KYC and client onboarding; fraud detection and fight against vendor scams; e-invoice reconciliation; and account-to-account validation.

Read on to learn about these use cases and GLEIF’s pilot engagements:

The Value of the LEI: Cross-Border Payments Pilot Engagements

| Faster, Cheaper KYC & customer onboarding | Enhanced Fraud and Vendor Scam Detection & Corporate Invoice Reconciliation | Greater Accuracy Account-to- Account Owner Validation | Increased Efficiency in Screening (e.g. Watchlists & Sanctions) |

|---|---|---|---|